Can India Replace China as the World’s Manufacturing Hub?

Behind Asia

Mar 26, 2025

Voice over: India’s fast growing economy has sparked interest about its future. Many observers have wondered whether India, which is now the world’s most populous nation, would eventually be able to replace China as the world’s manufacturing hub. Indeed due to the immense foreign investments that India has been receiving every single year, and the fact that China’s rising labor costs coupled with a Western decoupling has led many to believe that India may be on track to actually replace China as the leading manufacturing hub for many Western economies.

But just how true is that? Does India really have the means to replace China, or is it all just optimism without substance? Well, to understand whether India can actually replace China, let’s first set the stage and consider the factors that convince one to believe that India can replace China. The first is demographics.

When we graph out India and China’s population side by side, we get to see that India has indeed surpassed China when it comes to population size here. One can see that in 2023. India’s population size reached over 1.44 billion, whilst China sits at only 1.42 billion. But this isn’t really the data that we need to look at.

What this data misses is the fact that China’s population size is shrinking, and also that China has a much more rapidly aging population. Here’s a graph on the annual change in population for both countries here. You can easily see what’s wrong with China. You can see that China didn’t just increase its population.

It has seen a decrease in 2022, China saw its population go down by 1.26 million, and then a further decrease of over 2.59 million. This is projected to continue towards the future. India, on the other hand, even though it saw its population growth, slow down, is still seeing positive growth. In fact, in 2023, India even saw an increase of over 12.65 million.

That’s a substantial increase as it is a figure that China hasn’t seen since 1993. Put simply, India is adding more people in a single year than China has in decades, and that changes everything. More people means more potential workers, more consumers, and more economic energy. This kind of growth gives India an edge, not just in terms of labor supply, but in domestic market size.

And on top of that, as we mentioned earlier, China’s population is also aging. If we graph out the median age of both nations, we get to see that China’s population is much older as compared to India’s. Here you can even see projections made. Which showcases that even until the next century, China’s median age would be much more than India.

This demographic issue is basically the problem of China as a long-term manufacturing hub. A shrinking and aging population leads to a reduced labor force, higher wages, and increased pressure on social services like pensions and healthcare. India, on the other hand, is in the sweet spot of its demographic window.

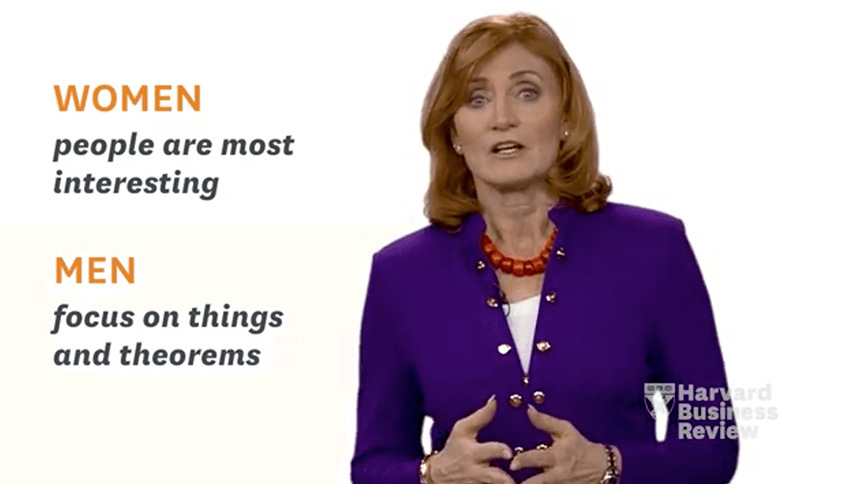

With a median age of just 28.1 years, as of 2023, India’s workforce is expected to remain young, dynamic and growing for the next few decades. But of course, demographics alone doesn’t guarantee economic success. What matters more is how these nations governments enable their own countries to grow, whether that be in attracting foreign investments, pursuing an export led manufacturing strategy.

Ensuring policy stability that builds trust with global corporations. Manufacturing specifically is what we need to understand the most, because for a very long time it has been the backbone of China’s economy for the most part. However, India still lags very far behind when it comes to this category today.

For instance, if we graph out the merchandise exports of both countries, which measures the total value of goods a country sells to the world. The gap between China and India becomes even clearer. In 2023, China’s merchandise exports reached a staggering $3.38 trillion, which makes India’s merchandise exports pale in comparison as it only exported just $431 billion.

This stark contrast illustrates the scale and maturity of China’s manufacturing base. China is not only exporting high volumes, but is also deeply embedded in global supply chains. It manufactures everything from low-end textiles and toys to high-end electronics, machinery, and industrial components. In fact, many countries, including India, still rely on China for critical inputs and parts.

But here’s where India can possibly overtake China, and its in foreign investments and labor costs. As we mentioned earlier, China has seen its labor cost rise over the past few years, and on top of that, there have been challenges related to Western sanctions, tariffs, and political tensions, especially with the United States and the European Union.

This has made Western companies more cautious about relying too heavily on China for manufacturing. As a result, there’s been a noticeable shift in global corporate strategy. Many firms are looking to diversify their supply chains, and India is emerging as a top alternative. If we graph out the average yearly salaries of India, we get to see that as of 2023, they have over 240,300 rupees per year, which amounts to around 2,900 US dollars per year.

That’s not really that big and is in fact so much smaller than that of China. China, if we graph it out, we get to see that for 2023, they have average yearly wages of 121,000 renminbi, which sits at around 16,900 US dollars per year, which is insanely high as compared to the average yearly salaries of Indian workers.

This difference is crucial amidst the global reconfiguration of supply chains for companies looking to cut production costs while maintaining scale. India’s labor cost advantage becomes a key incentive. Unfortunately, if we take a look at the foreign direct investments, net inflows of both countries, we get to see that China is still far ahead when it comes to attracting overall foreign direct investment.

But as you can see in the graph, China’s FDI net inflows actually dropped massively as compared to India. China’s FDI net inflows shrunk to just $42.73 billion the lowest ever since the start of the 21st century. This may mean that China’s golden era of being the world’s uncontested investment magnet could be coming to an end, but then again, just because there’s a drop in FDI net inflows for 2023 may not fully equate that India can already take over China’s position as the world’s manufacturing hub.

In fact, even though China’s labor costs have risen, they have been prioritizing their manufacturing competitiveness, which is productivity. Chinese factories are now increasing their investments in industrial robots and AI driven manufacturing. According to the International Federation of Robotics, China installed over 290,258 units for 2022.

Which if compared to India, makes them the global leader by a massive margin. These industrial robots are crucial, as it indicates Chinese factories are moving up the value chain, producing more advanced goods with higher precision. India’s manufacturing has traditionally been focused on lower tech sectors, textiles, basic chemicals, simple electronics assembly, et cetera, and small scale enterprises.

For India to truly replace China, they would need to boost productivity and quality, but there are positive signs. For example, India has become the world’s fourth largest car producer by volume, making around 4.4 million vehicles in 2022. Global automakers operate efficient plants in India, Maruti, Suzuki, Hyundai Tarter, et cetera.

Some have made India an export hub for certain models. The reason why this matters is because it shows that India can indeed compete in high volume, high efficiency manufacturing when the right ecosystem is in place. The automobile industry in India demonstrates what’s possible when there is sustained investment, skilled labor, strong supplier networks, and supportive government policy.

It proves that India isn’t just a market for consumption. It can be a reliable base for global production and exports. So as you can see, after examining these factors, where do things stand in the contest of India versus China? Can India really replace China? Well, China has built enormous economic advantages over the past 30 years from world, world-class infrastructure to a vast manufacturing base and deep integration into global trade.

India is coming from behind on all these fronts. In absolute terms, China’s economy around $18 trillion. GDP is about five times the size of India’s around $3.5 trillion. GDP China’s per capita income, over $12,600 is roughly five times, India’s approximately $2,300. These gaps will not vanish in a decade.

India is not going to replace China in the global economy in the near term. China is simply too big a player. However, India doesn’t need to fully replace China to be enormously successful. Even capturing a portion of what China currently dominates would mark a transformation for India, and there are strong indications that this is already happening and will accelerate consider economic growth rates.

China’s era of double digit growth is passed. Its growth has slowed to around 5% or less recently. Even before COVID, China’s growth was trending down due to a maturing economy and demographics. India, on the other hand, has been growing at around six to 7% annually in the last decade. Barring the 2020 COVID crash in the post COVID rebound year of 2021, India’s GDP grew 9.6%, one of the fastest among major economies.

While China grew 8.4% coming off a low base. IMF projects that in the next few years, India will grow around 6% plus annually versus China around four to 5%. If those projections hold the gap between the economies will narrow over time. India’s GDP could double by 2030, reaching approximately $8 trillion, while China’s might grow by half to approximately 25 to $30 trillion.

So as you can see, despite the strong growth. India can’t really replace China. At least not completely and not imminently. But anyway, do let us know what you think. Thanks for watching.

Source: https://youtu.be/xyNBe0deZZg